High commodity prices provide an incentive for exploration to increase supply. The 7-10-year lag in this process explains why booms tend a similar time. The rise in exploration spending drives up the cost of exploration inputs where their supply is relatively inelastic.

Engineers are an example, where real average salaries roughly doubled in the boom. Truck drivers in remote locations also received high real wages given the skills needed, but are now often replaced by software (‘driverless trucks’) as firms try to reduce costs.

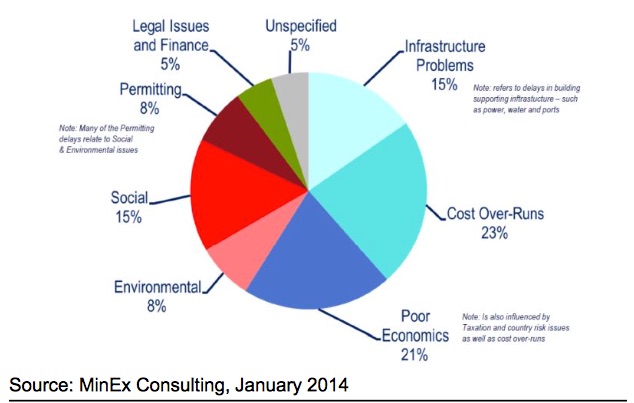

Rising commodity prices (especially oil) creates a headwind to new supply as it increases the development and operating costs. MinEx Consulting research suggests cost over-runs were the key cause of delays for copper projects over the last two years. But as commodity prices fall, this should reduce capital and operating costs, which will be a tailwind for supply.

Cost over-runs a key delay to copper projects but this should ease as the cost of inputs falls again.

There is a view among some that declining grades and the need to drill in deeper and more remote and risky locations will increase finding costs over time. We disagree, as we see a cycle in finding costs that is driven by the underlying commodity price. As prices fall, we see lower exploration activity, reduced demand for exploration inputs, and a consequent decline in the per-unit cost of exploration. Managements will also focus on the more prospective areas, and use lower cost technologies, which also helps to reduce costs.

An examination of the discovery costs for an ounce of gold (below) show the cycle in costs over time. Discovery costs have been elevated in a period of high prices, but they also fell from much higher levels in the 1970s/80s and we see this happening again.

Macquarie Global Horizon, 10 November 2014

Click here for the full newsletter, available from the Macquarie Bank web site.